Tax on expenditure: what is it?

Expense-based taxation, also known as lump-sum taxation, is a unique taxation system for foreigners. Unlike traditional income-based tax systems, this mechanism focuses on the taxpayer's expenditure.

It covers a variety of expenses, from annual rent to property maintenance, children's school fees and so on.

In Geneva, the tax threshold is set at a minimum of CHF 400,000, which is then treated as taxable income. The minimum amount is indexed to keep pace with economic developments, particularly inflation.

Applicants must apply for this scheme as soon as they arrive in Switzerland in order to benefit from it.

Conditions to be met

Expense-based taxation is specifically designed for foreign nationals who choose Switzerland as their place of residence without engaging in gainful employment.

Les conditions pour bénéficier de ce système sont strictes :

- Nationality: Individuals with dual nationality, including Swiss, are excluded.

- Tax liability: Unlimited (income and total assets)

- Durée de résidence : Pour ceux qui reviennent en Suisse après un départ, une absence d'au moins dix ans est requise.

- Restrictions : Les bénéficiaires ne doivent pas exercer d'activité lucrative en Suisse.

The spouses living together must both satisfy all the conditions.

Tax calculation

The tax base in Switzerland is determined on the basis of the expenses related to the taxpayer's lifestyle, not only in Switzerland but also abroad, as well as the individuals dependent on him.

This mechanism, which is specific to Switzerland, is designed for foreign nationals who choose to reside in Switzerland without being gainfully employed. In general, this amount is discussed and negotiated with the tax authorities of the canton in which the taxpayer resides. However, there are thresholds that must be respected.

Seuils à respecter

The amount may not be less than the highest of the following criteria:

- Un seuil minimum défini par le canton, comme celui de Genève qui est fixé à 400'000 CHF, traité comme un revenu imposable.

- Seven times the annual rent or rental value of the taxpayer's principal residence.

- Trois fois le coût annuel de la pension, englobant l'hébergement et la nourriture.

Impôt forfaitaire

The flat-rate tax, or "taxation according to expenditure", must at minimum correspond to what would be charged under the standard tax system. This calculation is based on several gross elements, such as:

- Property in Switzerland and its yield.

- Les biens meubles présents en Suisse et les revenus qu'ils génèrent.

- Les capitaux mobiliers déposés en Suisse, y compris les créances garanties par une hypothèque, et leurs rendements. Il est à noter que les titres étrangers, même s'ils sont conservés dans une banque suisse, sont traités comme des actifs étrangers.

- Les droits d'auteur, brevets et autres droits similaires exploités en Suisse et leurs revenus associés.

- Les pensions, rentes et autres revenus similaires d'origine suisse.

- Les revenus qui profitent d'une réduction d'impôt étranger en vertu d'un accord de double imposition signé par la Suisse.

Contrôle annuel

Each year, the tax authority carries out a check by comparing the tax based on these elements with the tax based on the lump sum, the higher amount will be retained.

Déclaration des éléments

It is essential to stress that only the items listed above must be declared by taxpayers subject to lump-sum taxation. This means that foreign income that is not covered by a double taxation agreement and assets held abroad are not reportable.

Application procedure and formalities

When settling in Switzerland, in addition to the formalities undertaken with the Cantonal Office for Population and Migration (OCPM), it is imperative for the newcomer to submit a structured request to the competent tax body. This request must contain :

- Correspondance étoffée : Offrir un aperçu exhaustif de la situation du contribuable, englobant les dimensions civiles, professionnelles et financières. Cette lettre doit également certifier que le contribuable n'entend pas entreprendre une activité professionnelle rémunérée sur le territoire suisse.

- Évaluation préliminaire : Fournir une évaluation préliminaire du montant sur lequel la taxation sera effectuée.

- Preuve de résidence: Pour les locataires, une copie du contrat de location sera nécessaire. Pour les propriétaires, un document attestant de la valeur locative sera requis.

- Pour les locataires : une copie du contrat de location.

- Formulaire officiel : Remplir le formulaire élaboré par l'administration fiscale, qui recueille des détails pertinents sur le niveau de vie du contribuable, ainsi que des personnes financièrement dépendantes de lui. L'objectif est d'appréhender l'ensemble des dépenses, en excluant les investissements.

À Genève, tous ces documents doivent être envoyés à l’adresse ci-dessous :

Administration fiscale cantonale

Service de la taxation des particuliers

Case postale 3937

1211 Genève 3

Formulaire à Remplir

Formulaire à remplir : taxation according to expenditure

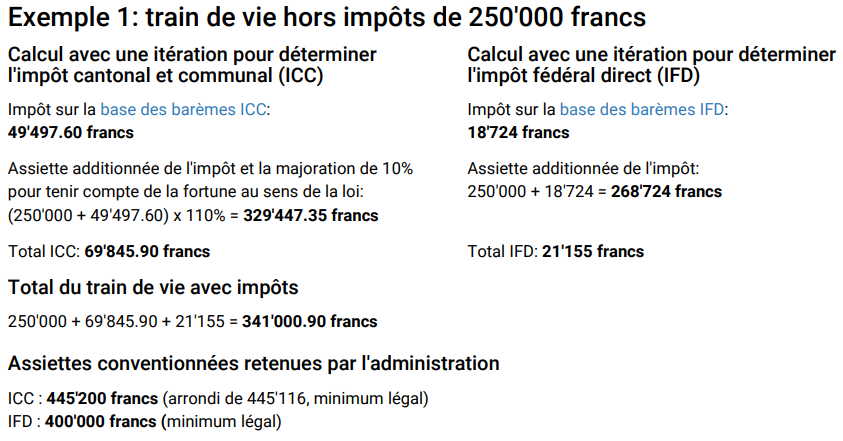

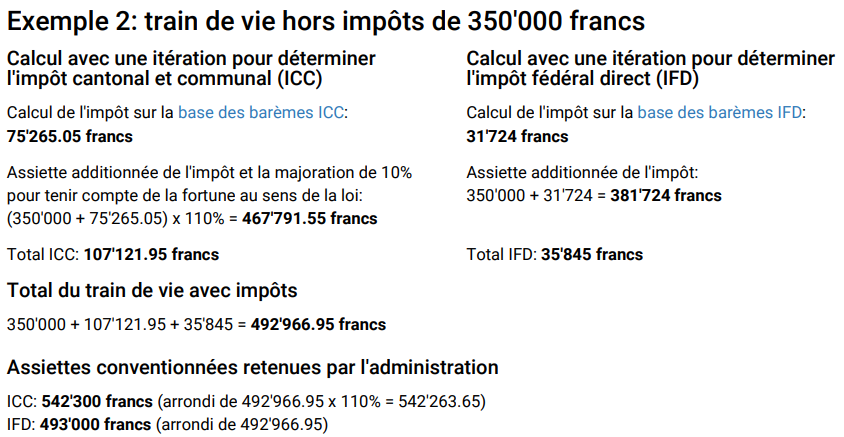

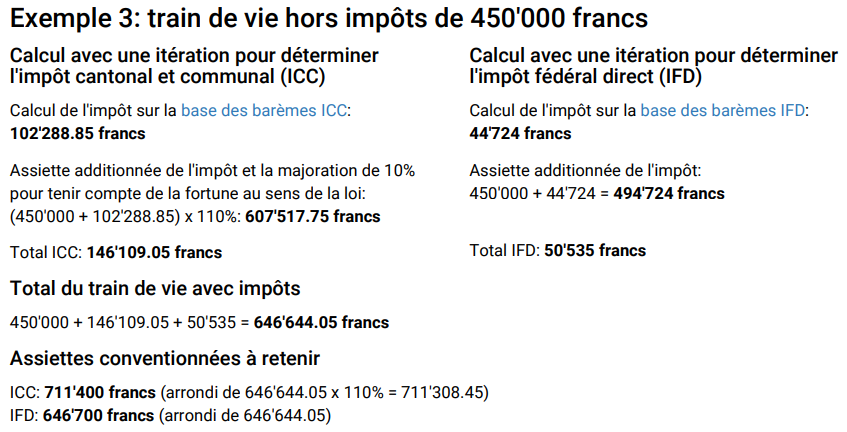

Exemples de calculs

The examples below are provided by the Geneva administration. To illustrate them, they are based on the following situation:

EU taxpayer, married, resident and owner in Cologny, gross rental value of CHF 48,000.

Modifications, adjustments and indexation

Tax treaties are regularly adjusted to reflect economic and inflationary changes.

For example, for the 2023 tax period, the indexation index is set at 106.2, leading to adjustments in taxable amounts.

Deductions, exceptions and implications

One of the special features of this system is the absence of deductions if taxation is based on expenditure or rental value.

However, if the control calculation is used, certain deductions, such as building maintenance costs and administration costs for movable capital (provided these are taxed) are permitted.

For further information: Déductions fiscales à Genève en 2025.

Conclusion

Expense-based taxation is a unique feature of the Swiss tax landscape, offering foreign nationals an opportunity for tax optimisation. However, navigating this regime requires a thorough understanding and careful planning to maximise the benefits while remaining compliant with the legislation(s).